Thanks to the independent support and generosity of companies our teams can provide emergency medical care where it is needed most.

Use the tabs below to find out more about how your company can support Médecins Sans Frontières/Doctors Without Borders (MSF).

Why partner with us?

Your brand

Defining your company’s identity as a purpose-driven brand, helping you to stand out and to differentiate you from others.

Long-term partnerships

We work closely with our partners to build meaningful, long-term relationships.

We start by getting to know you and your company, building an understanding of each other and exploring how we can create a mutually beneficial partnership.

Here are several ways our dedicated team will support you throughout the year:

Our corporate partners

How our corporate partners make it possible for MSF to provide lifesaving medical care to those who need it most.

Euromonitor

Euromonitor International (EMI) has proudly partnered with MSF since 2017, solidifying its status as one of our esteemed and enduring Headline Charity Partners.

“Our collaboration with MSF extends far beyond a simple annual contribution, reflecting EMI's unwavering commitment to making a meaningful impact. At EMI, we actively engage with the exceptional MSF team, drawing inspiration from the remarkable work of doctors and nurses in the field. Moreover, we provide pro bono support to enhance the efforts of MSF's core fundraising team.

In light of recent challenges, EMI took the opportunity to reassess our charity partnerships and the projects we champion. It became clear that MSF holds a special and strategic position among them all. By providing unrestricted funding, we can feel part of every emergency response launched by MSF, and in most cases, MSF is our charity of choice for global fundraisers in natural disasters as well as humanitarian crises.

This strategic alignment not only showcases EMI's dedication to social responsibility but also underscores our agility and efficiency in responding promptly to global challenges. The appreciation expressed by our employees attests to the positive impact generated by our collaborative efforts with MSF.”

Eva Harput, Global Head of CSR

Herbert Smith Freehills LLP (HSF)

"Our support for MSF started over 15 years ago through the provision of pro bono legal services in Australia but expanded over time, culminating in a five-year global commitment to donate £2 million through donations, fundraising, volunteering and pro bono support. During that time hundreds of my colleagues supported MSF, through fundraising events, providing pro bono legal support, skilled volunteering to support their HR team and volunteer mappers taking part in the missing maps project.

Having visited their operational centre in Brussels, I will always be deeply impressed with the work they do, their commitment and professionalism, from their medical and logistical volunteers, leadership team and the fundraising teams across all their offices that we enjoyed partnering with. Supporting MSF allowed us to have a proactive approach to supporting humanitarian emergencies and it’s a partnership that we have been extremely proud of."

Alison Brown, Executive Partner EMEA, UK and US, Herbert Smith Freehills LLP

CMS Cameron McKenna Nabarro Olswang LLP

CMS have been supporting MSF since 2020 as their global charity partner. Engagement with MSF has been widespread across different areas of the firm, from the CMS Football Cup – where donations are made to MSF for every goal scored - to Quiz Nights and fundraising initiatives led by our internal networks, such as the Muslim Network who fundraised as a part of their Ramadan Iftar events.

“Our long-standing relationship with MSF is a holistic one, going beyond year-round financial support. We provide MSF with a range of pro-bono support from legal advice, meeting and event space, and gifts in kind. We have been able to engage our people in a variety of fundraising opportunities, educating them about the amazing work MSF does around the world. We value our strong and excellent relationship with the team at MSF UK.”

Louise Starling, Senior Responsible Business & Social Impact Manager at CMS

More corporate partners

99 percent of our funding comes from private donors. Corporate support is vital in enabling us to deliver life-saving medical care to those in urgent need around the world.

We collaborate with businesses from a diverse range of industries who are aligned with our values and mission. Our global reach helps companies to build purpose-driven brands, unite employees, and respond to crises in the countries where you work. Below are some more examples of our corporate partners:

- ACT

- Aesop

- Apax Foundation

- Bloomberg

- Bloomsbury Publishing Plc

- Capco

- Cisco

- CMS

- Equal Experts

- Euromonitor

- Hogan Lovells

- HSF

- Mott MacDonald

Payroll Giving

Payroll Giving is an easy and tax-effective way to make regular donations.

Payroll Giving is the only way that your donation can automatically go up to 45 percent further.

By giving to us regularly from your pay, we automatically receive the tax you would have paid on the donation (your payroll department sort this out for us).

Also, we don't need to claim Gift Aid back on this. So less admin for us, and no Direct Debit needed from you!

Payroll Giving is also the only way for anyone paying 40 percent or 45 percent tax to give us all their tax on a donation automatically.

If you earn over £42,385 per year this is the best way for you to support us tax effectively.

|

You donate to us on a monthly basis |

We receive (20% tax payer) |

We receive (40% tax payer *) |

We receive (45% tax payer*) |

|---|---|---|---|

|

£5 |

£.6.25 |

£8.33 |

£9.09 |

|

£10 |

£12.50 |

£16.67 |

£18.18 |

|

£15 |

£18.75 |

£24.99 |

£27.27 |

|

£20 |

£25 |

£33.32 |

£36.36 |

* Please note that we have calculated that the 40 percent higher rate tax band starts after earning £41,865 GROSS per year (including personal allowance of £10,000) and 45 percent super tax is applicable to those earning over £150,000 gross per year (this includes any and all personal allowances that might or might not be applicable).

Matched giving

Some employers also offer to match your donations through their payroll giving schemes.

Why not ask your employer if they will match your gift?

Setting up Payroll Giving

If you or your employers would like to discuss setting up payroll giving please fill in our contact form below.

Or set up Payroll Giving at Giving Online website.

Making a normal donation

Alternatively, you can set-up a one-off or regular donation.

Our corporate gift acceptance policy

At the core of MSF’s identity is a commitment to independence, neutrality and impartiality.

These principles allow us to gain the acceptance of the local people in countries where we work and to speak out when we see injustice. They are key to keeping our teams safe.

It is for this reason that we do not take funds from organisations working in industries that conflict with our humanitarian goals and values, or which may limit our ability to provide humanitarian assistance.

If your company is in the asset management, gambling, alcohol, healthcare or medical device sector, please do get in touch to discuss any possible donation.

Médecins Sans Frontières / Doctors Without Border (MSF) UK Corporate Gift Acceptance Policy

As a humanitarian medical aid organisation MSF strongly believes that we must not accept gifts from organisations or industries whose activities are in conflict with our goals and values, as set out in the MSF Charter.

MSF UK does not accept gifts from organisations that are in the following sectors:

- arms manufacturing and selling

- tobacco manufacturing and selling

- pharmaceuticals

- extraction.

MSF UK will also review and assess potential donations from organisations that are connected to these industries.

MSF UK may not accept gifts from other sectors including, but not limited to, the following:

- asset management (companies investing assets of clients and/or providing expert advice on asset investment and portfolio management)

- gambling

- alcohol

- healthcare

- medical devices.

If your company is in one of these sectors, please get in touch before making a donation.

If you would like to discuss any of the areas covered by our Corporate Gift Acceptance Policy, or have any questions, please do get in touch.

Thank you for your interest in supporting Médecins Sans Frontières.

If you are interested in making a donation to MSF through the sale of goods or services, please get in touch with our team using the form below ahead of any promotion.

Until a fully executed agreement is received, the use of Médecins Sans Frontières’ name, logo, or any of its licensed trademarks is prohibited.

Or, feel free to contact Abi Betts, MSF UK's Head of Philanthropy.

- By phone: +44 (0) 20 7404 6600

- By email: abigail@london.msf.org

Missing Maps

The most crisis-prone parts of the world need mapping. With your help, we can directly improve the lives of some of the planet’s most vulnerable people.

This is the aim of the Missing Maps, an open, collaborative initiative founded by Médecins Sans Frontières/Doctors Without Borders (MSF), the British Red Cross, the American Red Cross and the Humanitarian OpenStreetMap Team (HOT).

What is Missing Maps?

Missing Maps case study: Linklaters and MSF UK

“Missing Maps mapathons are brilliant! It’s great to know that with just a few hours of our time, we all collectively can make such a big difference to vulnerable communities around the world in need of help.”

Linklaters has provided support to Médecins Sans Frontières for over 10 years. Alongside annual funding, for the last four years we have harnessed our size to crowdsource information to strengthen humanitarian response. We've organised four global Missing Maps mapathons to map the most crisis-prone parts of the world - areas which currently lack digital maps. Access to accurate maps is vital for humanitarian aid organisations like MSF to deliver life-saving care.

A highlight for us was helping put Guatemala on the map. Guatemala is a country which is vulnerable to hurricanes and tropical storms, often leading to catastrophic floods and landslides, putting rural communities at risk. It can be challenging for aid workers to reach those in need when there is simply no digital mapping to locate settlements across the country.

Our first mapathon focused on Guatemala where we were an early contributor to the widespread efforts to map the country. A year later we returned. Guatemala was by then 90% mapped, and we were able to help get it over the finish line. Over the two mapathons, we identified an impressive 100,000 buildings, mapping an area home to approximately 500,000 people. Thanks to over 500 Linklaters volunteers – giving up time during and outside working hours - the digital information created through our mapathon is now helping Médecins Sans Frontières to deliver life-saving care more effectively.

We are proud of our long-standing partnership with MSF. The mapathons are a tangible example of how corporate partners can support the brilliant work of MSF on disaster response. Through the dedication of hundreds of volunteers, this initiative has demonstrated the powerful impact of collective effort in addressing global challenges.

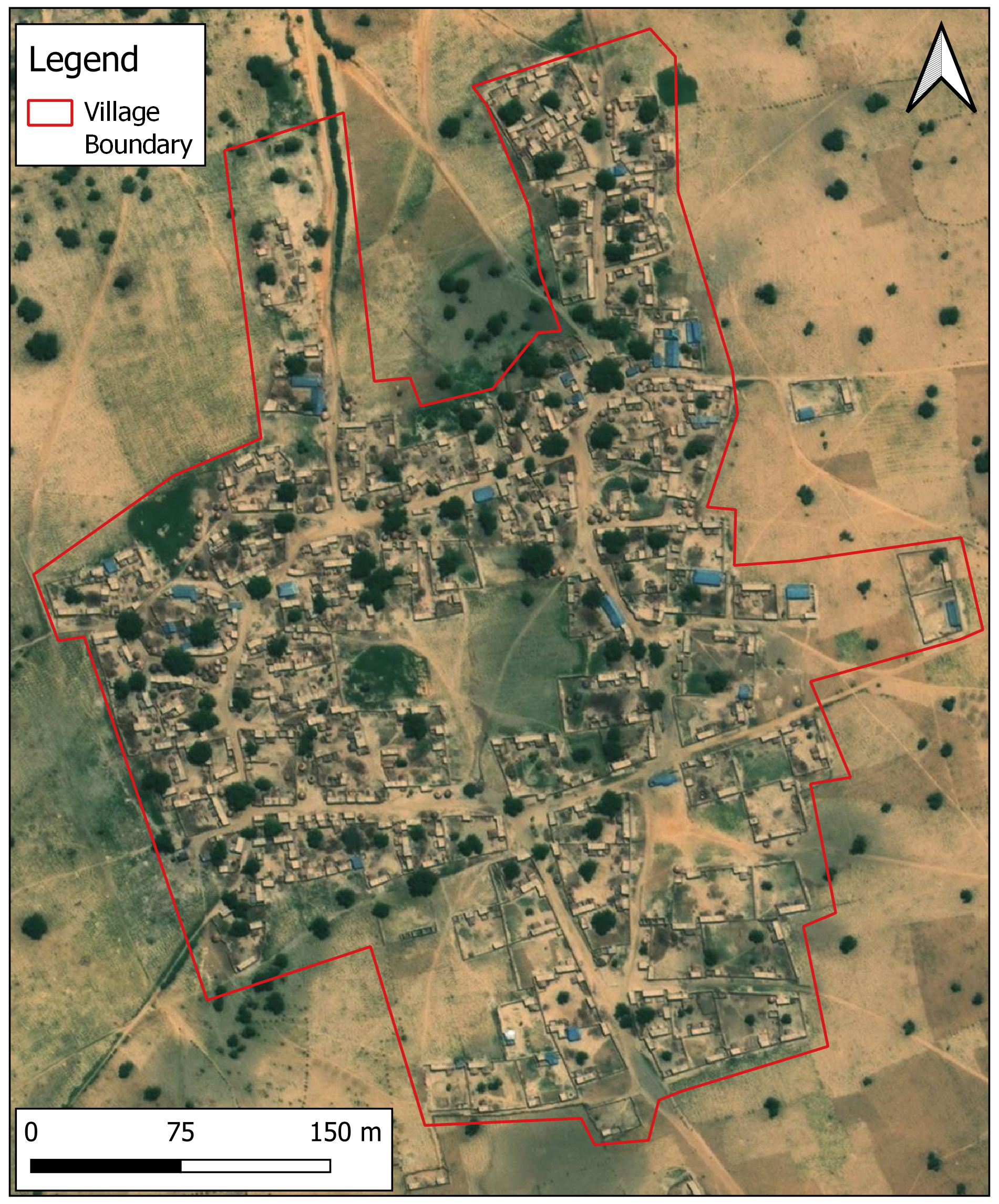

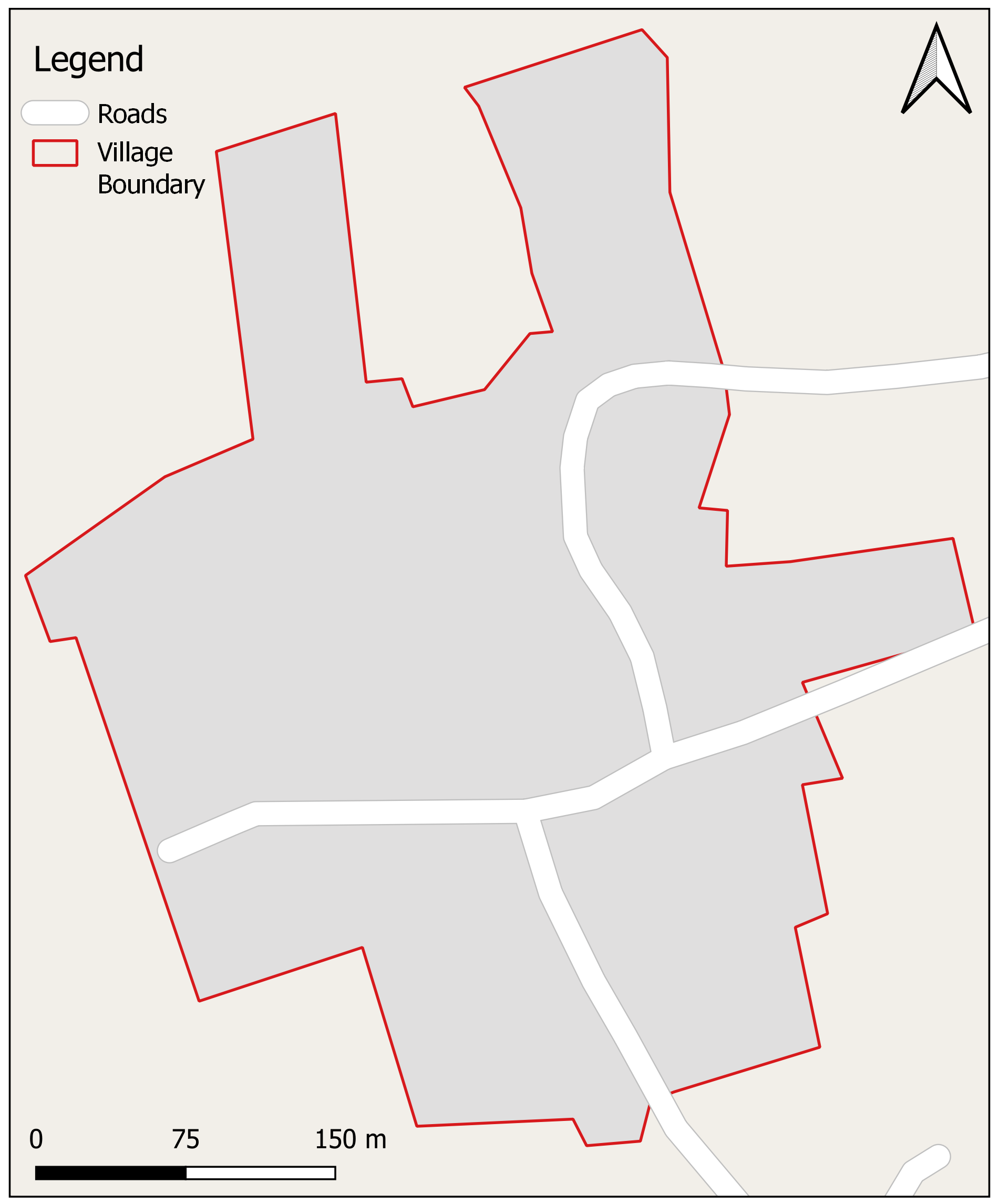

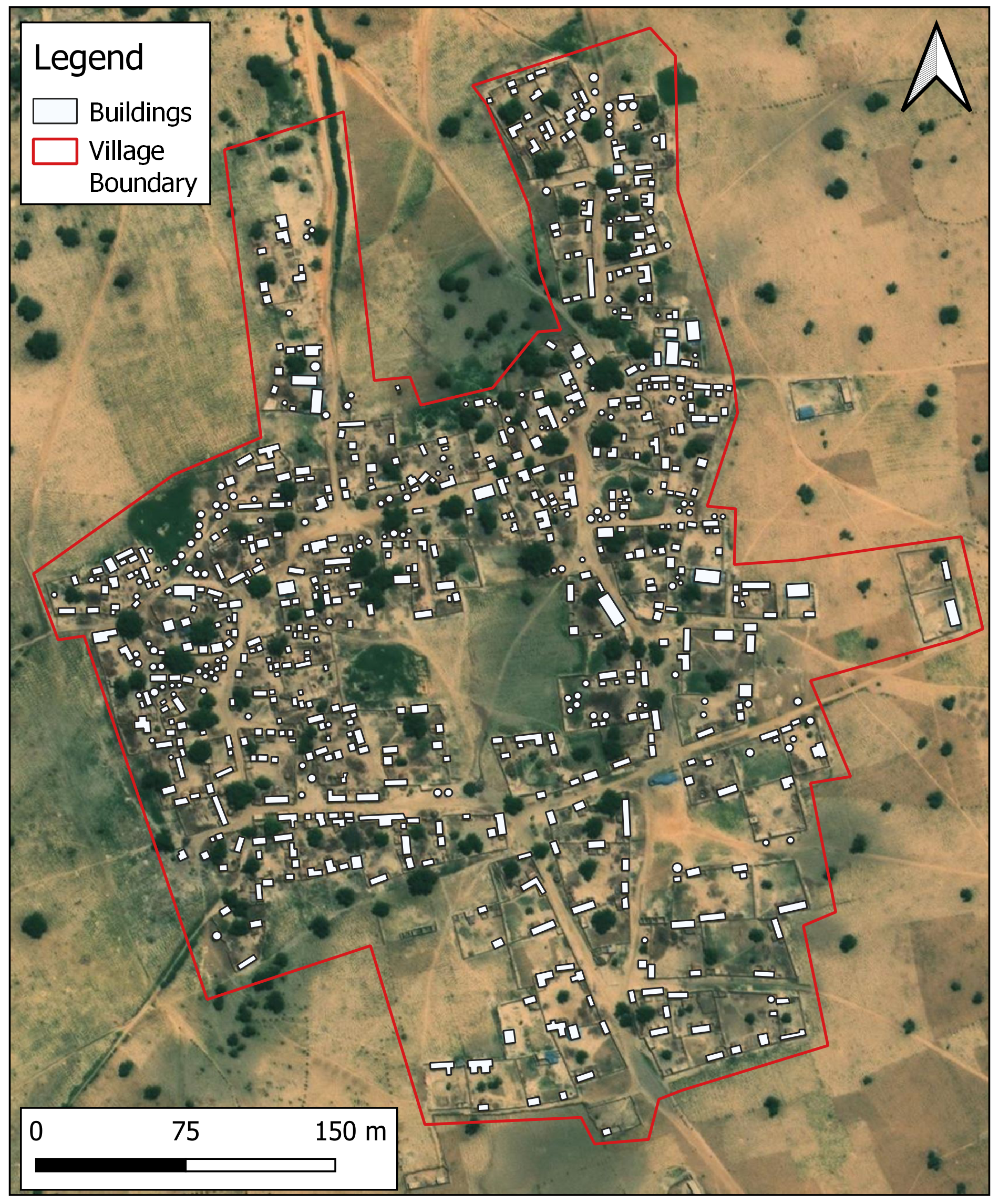

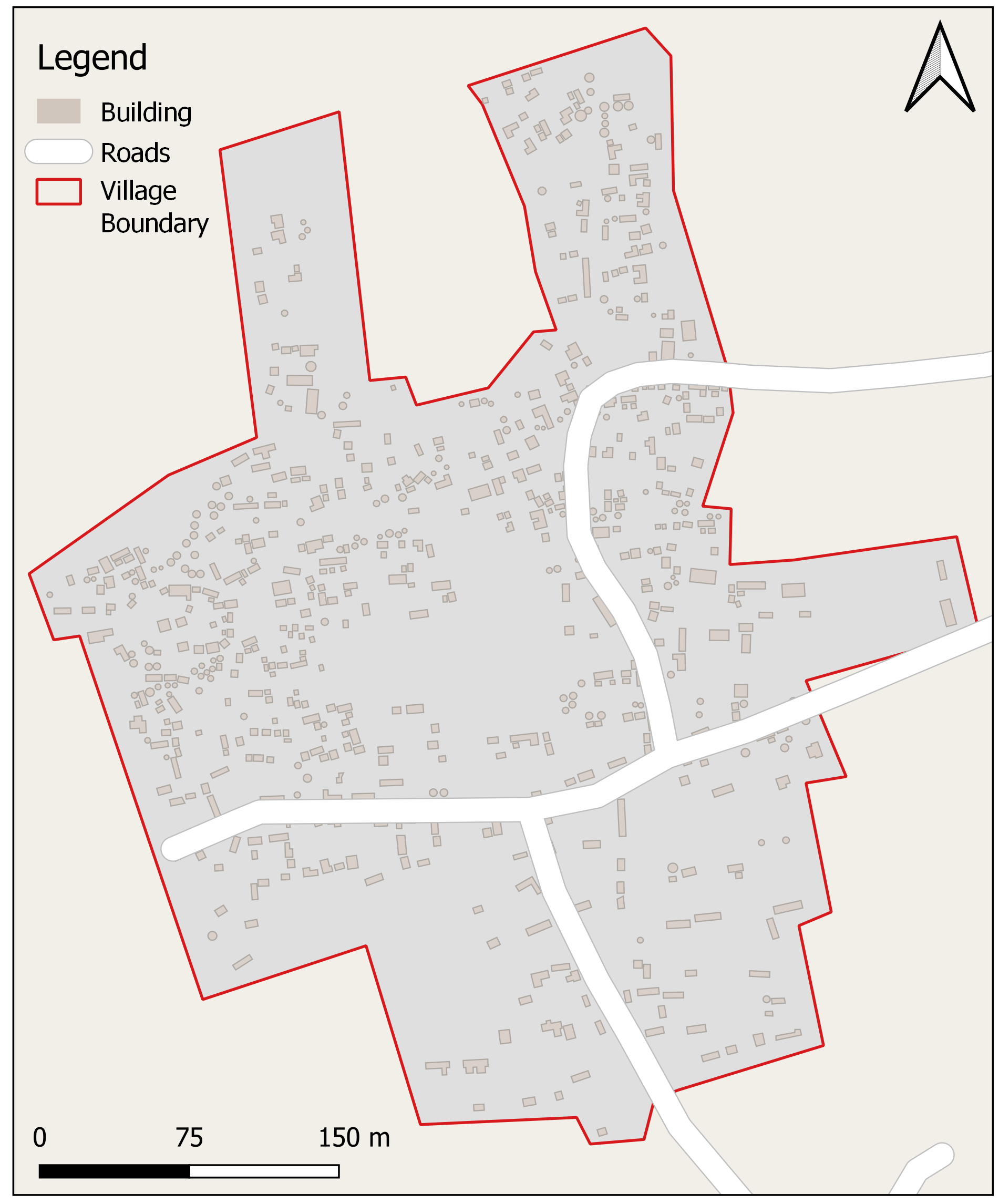

Managing noma in northwest Nigeria

The following is an example of a village in northwest Nigeria on satellite imagery and OpenStreetMap, before and after mapping. This Missing Maps campaign was requested to identify villages and towns in remote locations to help manage noma, a neglected disease.

Before mapping

After mapping

Get involved

If you and your company want to get involved with MSF or Missing Maps then please complete the contact form below.

How we spend your money

79p

OF EVERY £ DONATED GOES TO MEDICAL OPERATIONS

£6.32

RAISED FOR EVERY £ SPENT ON FUNDRAISING

8p

OF EVERY £ DONATED SPENT ON UK GENERAL SUPPORT COSTS

Get in touch

If your company is considering partnering with MSF UK please fill out our form and a member of the team will be in touch.

Fields marked * are required.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)